Evaluating Sphere Entertainment’s Share Price: Is It Truly Undervalued?

If you find yourself pondering whether Sphere Entertainment’s share price reflects its actual worth, you’re not alone. This article aims to clarify your queries regarding its valuation and what current market conditions indicate about the company’s future prospects.

Current Share Performance

The stock last closed at US$115.70, showcasing impressive returns: 24.1% over the past week, 17.8% over the last month, 22.7% year-to-date, and a staggering 140.0% over the past year. These figures naturally lead to questions about the extent to which future upside or downside is already baked into the current price.

Sphere’s High-Profile Venue

The recent buzz surrounding Sphere Entertainment has been largely attributed to its cutting-edge venue in Las Vegas, a landmark for live entertainment experiences. This venue’s prominence keeps the company in the spotlight, prompting many investors to reassess the delicate balance between its potential for growth and the risks associated with its reliance on a flagship asset.

Valuation Insights

Our valuation model assigns Sphere Entertainment a score of 2 out of 6. This modest score indicates that the stock screens as relatively undervalued based on several checks. Let’s delve into the different models used to assess this score, culminating in a more comprehensive view of the company’s value.

Approach 1: Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model provides a framework for estimating a company’s present value by projecting its future cash flows and discounting them accordingly. For Sphere Entertainment, the analysis employs a 2-Stage Free Cash Flow to Equity model.

Currently, Sphere Entertainment reports a loss of $272.47 million in free cash flow over the latest twelve months. Consequently, the valuation hinges heavily on future growth expectations rather than existing cash generation. Analysts expect free cash flow to turn positive in the coming years, with estimates suggesting a rise to $469 million by 2030. Projected intermediate milestones include $151.80 million in 2026 and $408 million in 2029.

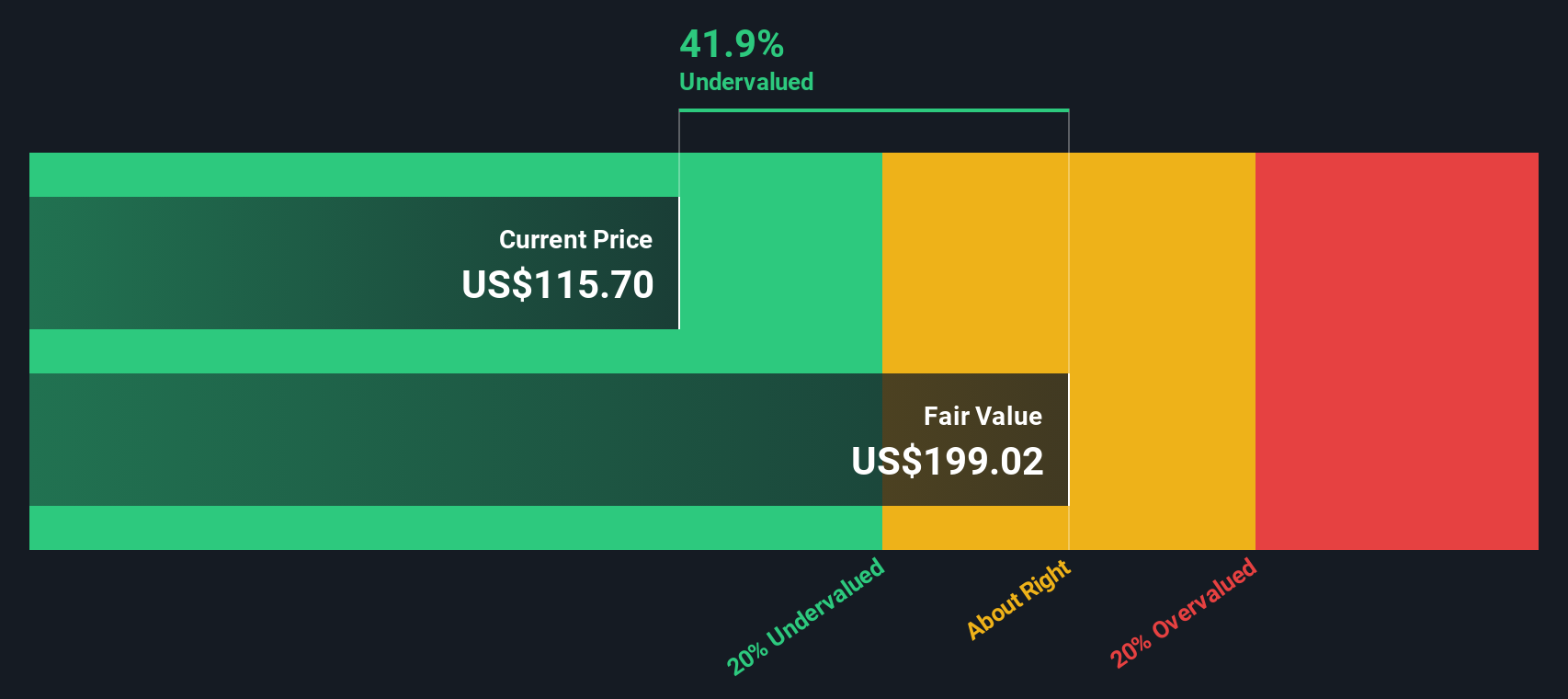

Applying the DCF model, the estimated intrinsic value of Sphere Entertainment’s shares lands at approximately $201.05. When juxtaposed with the current price of $115.70, this indicates the stock is around 42.5% undervalued based on our DCF evaluation.

Result: UNDERVALUED

Our DCF analysis points to Sphere Entertainment being undervalued by 42.5%. Interested investors can track this figure in their portfolio or discover additional undervalued stocks using the provided links.

Approach 2: Price vs. Earnings (P/E) Ratio

For companies that exhibit profitability, the P/E ratio serves as a useful gauge, illustrating how much investors pay per dollar of earnings. This ratio effectively connects share price to the fundamental profit figure.

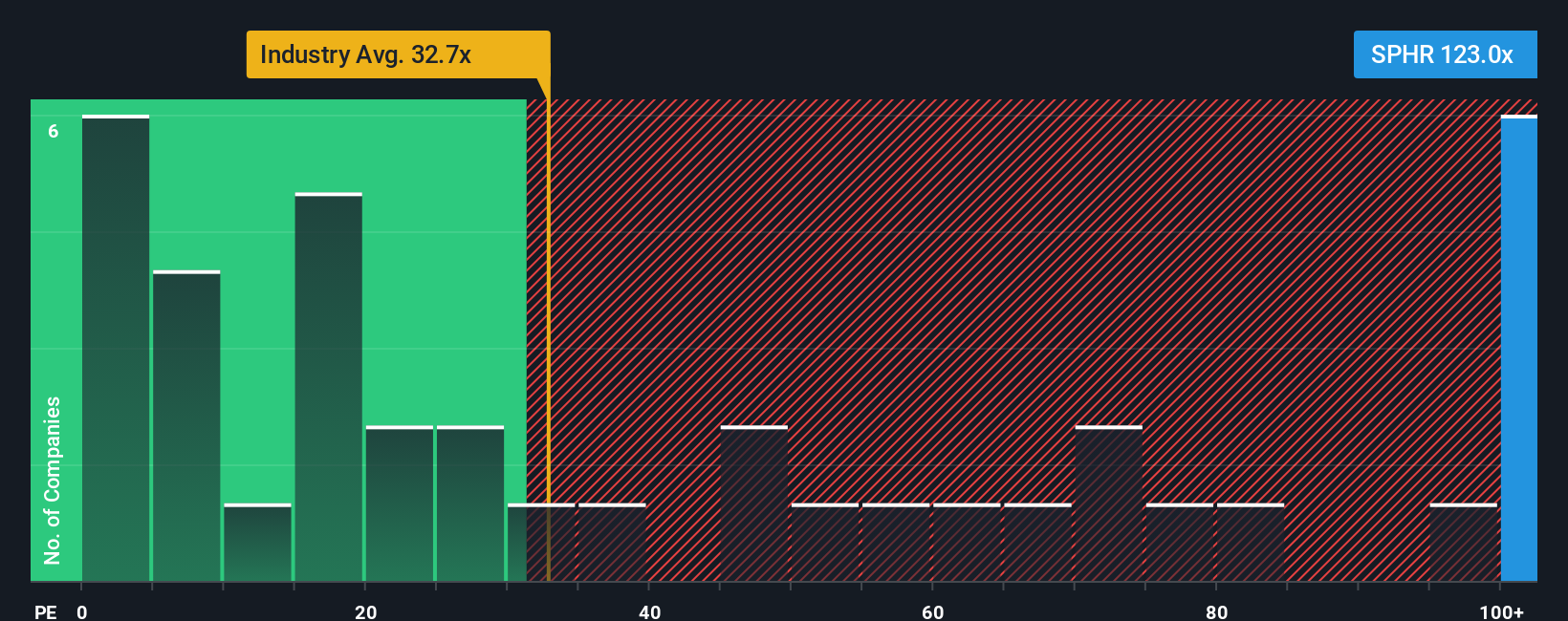

Currently, Sphere Entertainment’s P/E stands at 122.94x, significantly outpacing the entertainment industry average of 32.74x and a peer group average of 43.93x. Moreover, Simply Wall St estimates a "Fair Ratio" of 5.82x, tailored to factors such as earnings profiles, industry dynamics, profit margins, market capitalization, and specific risks.

When comparing the company’s current P/E of 122.94x to the Fair Ratio of 5.82x, it reinforces the narrative that Sphere Entertainment may be perceived as overvalued from an earnings perspective.

Result: OVERVALUED

In light of the P/E ratios, Sphere Entertainment emerges as expensive when viewed through this earnings-based lens.

Upgrade Your Decision Making: Craft Your Sphere Entertainment Narrative

To enhance your understanding of Sphere Entertainment’s valuation, Simply Wall St provides a unique Narratives feature that allows you to align your perspective with various revenue, earnings, and margin assumptions. This tool can help you derive a Fair Value and compare it with the current share price, aiding in your investment decisions. Projections range widely, from a more cautious $35 Fair Value to an optimistic $75 Fair Value, with updates reflecting new bookings data and earnings information.

Do you believe there’s more to Sphere Entertainment’s story? Engage with the community to explore diverse viewpoints on this intriguing company.

This synopsis from Simply Wall St is intended for informational purposes only. The insights provided are based on historical data and analyst forecasts using an unbiased approach and do not represent financial advice. The content does not constitute a recommendation to buy or sell any stock and does not consider your specific financial objectives or situation.