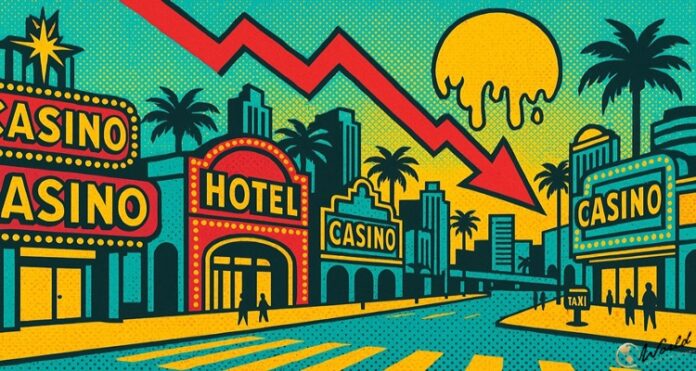

The slowdown in Southern Nevada tourism is rippling across the Las Vegas Strip, and even The Strat — one of its most iconic properties — has not been spared. Golden Entertainment, which operates the resort, reported a dip in both revenue and occupancy during the second quarter, reflecting a broader softening in visitor demand.

Prices and Perceptions Shape Visitor Behavior

In its most recent earnings call, Golden Entertainment shared that The Strat’s hotel occupancy averaged 69% for the quarter, a decline from 73% the previous year. June was particularly challenging, as occupancy plummeted to 60%, compared to 76% in June 2024. Company president and CFO Charles Protell noted the weakness on the Strip extended into July but mentioned that bookings have started to stabilize in August. Golden anticipates that stronger demand will return later in 2023, especially as group events and conventions begin to fill the calendar.

Golden Entertainment operates eight casinos in Nevada, along with 72 gaming taverns under brands like PT’s, Sierra Gold, and Lucky’s. The company reported quarterly revenues of $164 million, marking a 3% decline year-over-year. Operating income fell from $13.5 million to $11.9 million. The segment covering Nevada’s casino resorts generated $98 million, down from $101 million last year, a change attributed to lower visitation on the Strip and a poor table games performance in Laughlin.

While weekend business at The Strat remains robust, often exceeding 90% occupancy, weekday performance lags behind. To adapt, Golden has reduced certain amenities during slower days, leading to the temporary closure of some restaurants midweek. Protell commented that the company has “aggressively managed costs to mitigate the impact of lower revenue” during this challenging quarter.

Residents and visitors alike have cited pricing as a critical factor in the decline. Las Vegas local Regina Knight voiced her concerns over the rising costs, stating, “There’s no likelihood. It’s too expensive. Everything. Fees. Everything. It’s too expensive.” She reminisced about earlier visits when prices were more reasonable, expressing frustration about the current unaffordability of the city, even for locals.

Data from the Las Vegas Convention and Visitors Authority (LVCVA) highlights that the average Strip room rate in June was $174, with downtown rates averaging $87 — both showing slight declines from the previous year, including a nearly 7% drop on the Strip. Experts suggest that revenue management strategies result in sharp fluctuations in pricing. Alan Feldman of UNLV’s International Gaming Institute compared pricing to “a grease pole” that constantly shifts, noting that major resorts rely heavily on analytics and artificial intelligence to adjust prices swiftly.

Economic Signals Beyond the Strip

Las Vegas welcomed 3.1 million visitors in June, which represented an 11.3% decrease — nearly 400,000 fewer than in June 2024. This downturn has continued for six consecutive months, prompting concerns about broader economic trends. The LVCVA’s report identified “persistent economic uncertainty and weaker consumer confidence” as significant contributing factors.

Air travel into Harry Reid International Airport dropped by about 318,000 passengers in June, with declines seen in both domestic and international traffic. Road travel has also experienced a slowdown, evident in the 4.3% dip in I-15 border traffic from California.

International visitation, particularly from Canada, has notably decreased. Andrew Woods of UNLV’s Center for Business and Economic Research identified U.S. tariffs and strained relations as possible reasons for the reduction in Canadian tourists. Other analysts have pointed to stricter visa requirements and increased airport scrutiny as deterrents for travelers from several regions.

Despite these challenges, gambling revenue in June was marginally higher than the previous year, and convention attendance remains ahead of 2024’s pace. Industry analysts like Oliver Lovat suggest that some visitors may be postponing trips until major future events, including the Formula 1 Grand Prix and the 2026 FIFA World Cup.

Looking forward, Golden Entertainment is optimistic about potential economic boosts in 2026 due to recently approved tax relief on tips and senior deductions in Nevada. According to the Las Vegas Review-Journal, CEO Blake Sartini stated these changes could enhance local spending, which would benefit both its casinos and taverns. “We see a very positive outlook continuing for the local economy,” he affirmed.