![Electronic display boards at Hana Bank dealing room in central Seoul show financial markets on Jan. 23. [JOONGANG ILBO]](https://welcometovegasbaby.com/wp-content/uploads/2026/01/Is-the-surge-only-beginning.jpg)

Electronic display boards at Hana Bank dealing room in central Seoul show financial markets on Jan. 23. [JOONGANG ILBO]

The Kospi index recently broke the significant 5,000-point threshold, igniting discussions about the sustainability of this remarkable rally. Some analysts predict that the market could continue its upward trajectory, maybe even surpassing the 5,500 mark, while others caution against a potential pullback.

While there are sentiments about robust growth driven by strong corporate earnings and supportive government policies, critics are quick to highlight potential vulnerabilities. A significant portion of the gains has been concentrated in specific sectors such as semiconductors, and some stocks, including Hyundai Motor, are seen as inflated, lacking a corresponding basis in their earnings.

Following its leap over the 5,000-point mark, achieved just three months after clinching the 4,000-point milestone, the benchmark index finished at 4,990.07 points with a 0.76 percent rise. This impressive performance is largely attributed to institutional and foreign investment, showcasing a strong demand for South Korean stocks.

Further Upside vs. Imminent Correction

The Kospi has almost doubled within a year, significantly outperforming major indices in the U.S., Europe, and Japan. Analysts see more room for gains, citing the ongoing boom in the semiconductor sector and growing optimism regarding the automotive industry.

Optimistic projections suggest that substantial earnings from industry giants like Samsung Electronics and SK hynix could drive the index even higher. Park Seok-hyun, an analyst at Woori Bank, emphasized that the semiconductor sector’s earnings for the year are expected to exceed expectations. He predicts further upward momentum, with the Kospi potentially aiming for 5,500 points in the near future.

Samsung Electronics is anticipated to report an operating profit of 145 trillion won ($98.89 billion) this year, marking a 233 percent increase from the previous year, fueled by rising memory chip prices and limited supply. Similarly, SK hynix’s operating profit is projected to jump 154 percent to 115 trillion won. Analysts at KB Securities foresee the Kospi fluctuating between 4,200 and 5,700 points in light of what they describe as the initial phase of a structural upswing.

Park further notes that last year’s market growth was majorly linked to the semiconductor industry, as well as shipbuilding and defense sectors, but with this year’s rally expanding to include the auto sector, it has successfully propelled the index to the 5,000-point mark.

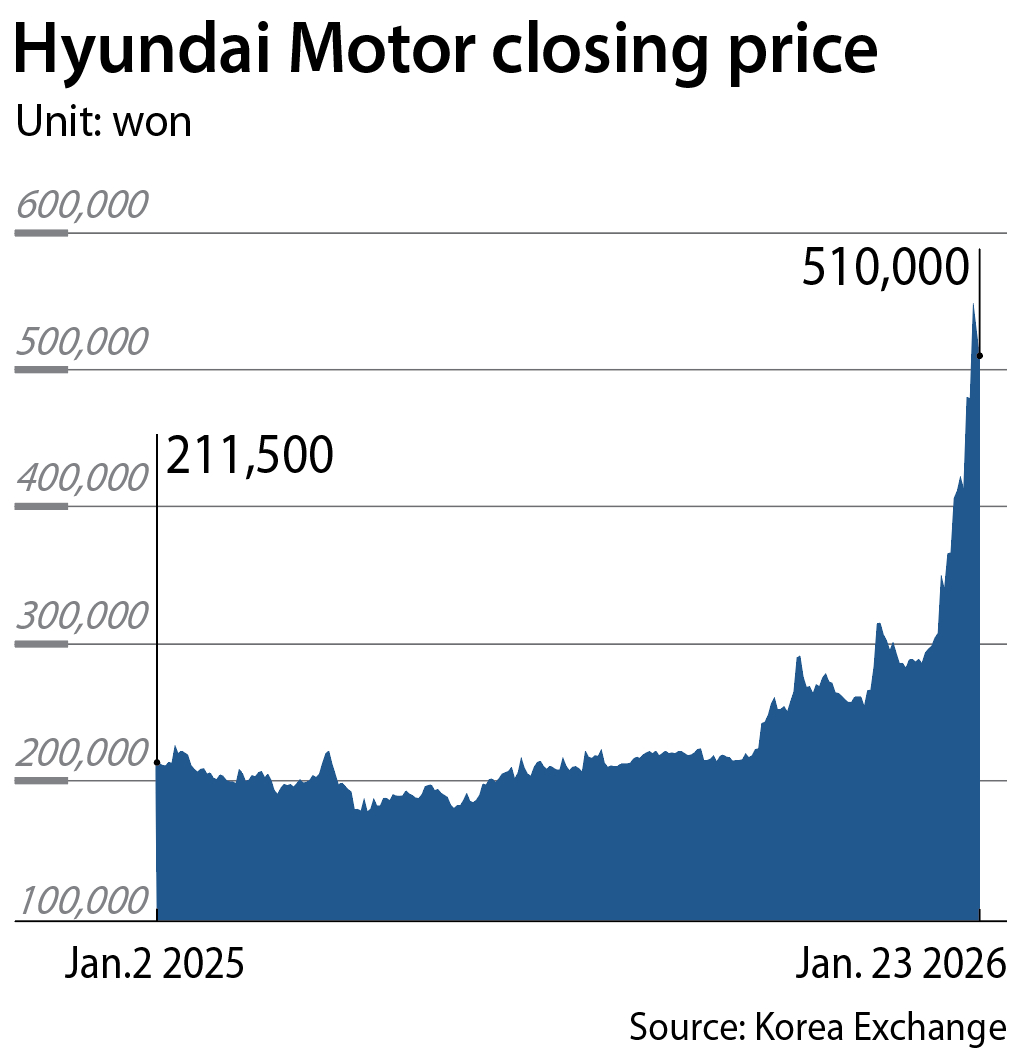

In a remarkable feat, shares of Hyundai Motor surged by 70 percent this year, elevating the company above General Motors as the world’s fourth most valuable automaker. This impressive growth has been largely driven by investor enthusiasm surrounding Hyundai’s venture into robotics, particularly highlighted by the unveiling of the life-size Atlas humanoid robot developed by Boston Dynamics, a subsidiary of the automaker.

The stock’s rally gained momentum earlier this month following the release of the latest version of Atlas, signaling Hyundai’s transition from a traditional automaker to a pioneering robotics company. However, some analysts caution that the rapid gains in Hyundai’s market could be speculative in nature.

Huh In, an economics professor at the Catholic University of Korea, pointed out that the recent rally primarily stemmed from speculation regarding the potential earnings implications of Hyundai’s investment in robotics, asserting that much of this promise remains unrealized, leaving room for considerable volatility.

Key Market Influencers

Moving forward, several critical factors will undoubtedly influence market performance, including the implementation of market-friendly policies in South Korea and overall U.S. economic conditions.

The South Korean government has committed to several ambitious initiatives aimed at improving the attractiveness and stability of the financial market. Key measures include the upcoming revision of the Commercial Act, which will allow for the cancellation of treasury shares, and the extension of foreign exchange trading hours from 2 a.m. to full 24-hour operations starting this July. This reform is anticipated to elevate Korea’s status in the Morgan Stanley Capital International (MSCI) index from emerging-market to developed-market status, potentially drawing in foreign inflows totaling between $5 billion to $36 billion.

Lee Won, an analyst at Bookook Securities, noted that these initiatives, along with efforts to boost shareholder returns, are likely to promote an increase in foreign investment and longer-term investment strategies.

Yet, traders must also stay alert to the influence of the U.S. economy on the Kospi, as many leading South Korean firms are heavily reliant on semiconductor exports. Any signs of economic weakening in the U.S. could lead to downward pressures on the index.

Professor Huh emphasized that if U.S. economic indicators compelled the Federal Reserve to cut rates, markets could face a downturn. However, he dismissed this scenario as unlikely, pointing out that recent economic indicators, particularly in the labor market, suggest a more stable environment than anticipated.

BY JIN MIN-JI [[email protected]]