The State of the Apartment Rental Market in 2025

Image Source: Yardi Matrix

The apartment rental market in the United States is currently navigating a landscape marked by subtle change and persistent challenges. Recent insights from Yardi Matrix reveal key trends in rent growth, occupancy rates, and the influence of economic uncertainty on multifamily investments.

National Rent Growth Trends

As of March 2025, the national average asking rent for apartments has shown a modest increase, rising by $5 to a total of $1,736 per month. Year-over-year growth stands at +0.9%, a slight decline from previous months. The month-over-month growth has been recorded at 0.3%, indicating a gradual rise in rental costs.

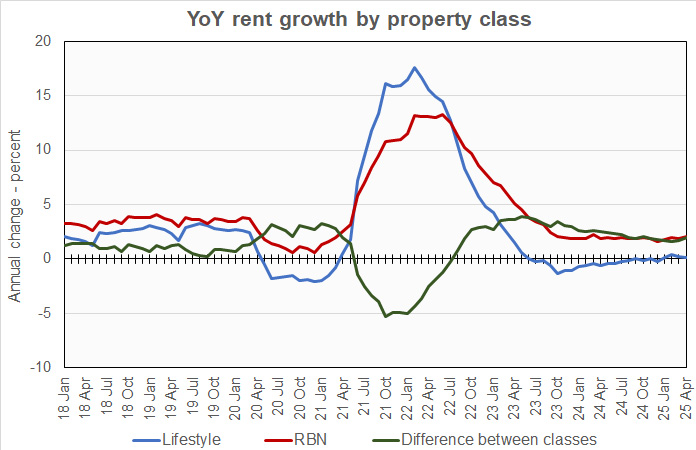

Differentiating Asset Classes

The rental market can be broadly categorized into two asset classes: "lifestyle" properties, typically Class A, and “renter by necessity” (RBN) properties. Year-over-year rent for lifestyle properties grew by only 0.1%, whereas RBN properties experienced a more significant jump of 2.1%. Notably, while lifestyle property growth has been positive for four consecutive months, it is starting to show signs of slowing, emphasizing the evolving dynamics in tenant demands.

Occupancy Rates Decline

According to Yardi Matrix, the U.S. average occupancy rate for apartments dropped to 94.4% in February, marking a minimal decrease from the previous month. This rate is now the lowest observed since November 2013, reflecting a broader trend of rising vacancies as the rental landscape undergoes transformations.

Economic Uncertainty and Multfamily Investments

A significant factor contributing to the current rental market is the overarching uncertainty surrounding economic policies. Discourse regarding President Trump’s tariffs and their effects on the multifamily sector has sparked hesitance among investors. One notable indicator of this unease is the steep decline in multifamily commercial mortgage-backed securities (CMBS) activity, dropping sharply in the early weeks of Q2 2025, despite a strong start in Q1.

While some traditional financing sources like Fannie Mae and Freddie Mac continue to lend, banks appear more selective, contributing to the cautious nature of new developments amid rising costs of materials and labor.

Detailed Metrics on Rent Growth

Yardi Matrix provides a comprehensive overview of annual rent increases across top metros. The following table outlines cities with the most significant rent growth:

| City | YoY Rent | YoY Rent Last Month | YoY Jobs (6 Mo Avg) | Completions as % of Stock |

|---|---|---|---|---|

| New York | 5.8% | 5.5% | 2.0% | 1.6% |

| Columbus | 3.7% | 3.5% | 0.9% | 3.8% |

| Philadelphia | 3.6% | 3.2% | 0.9% | 1.9% |

| Kansas City | 3.5% | 3.7% | 1.0% | 2.6% |

| Chicago | 3.3% | 3.7% | 0.6% | 1.7% |

Conversely, certain areas are witnessing a downturn. The following table highlights cities experiencing decreased rent levels:

| City | YoY Rent | YoY Rent Last Month | YoY Jobs (6 Mo Avg) | Completions as % of Stock |

|---|---|---|---|---|

| Austin | (5.6%) | (5.4%) | 2.1% | 8.8% |

| Denver | (3.9%) | (3.6%) | 0.5% | 6.2% |

| Phoenix | (3.1%) | (3.0%) | 0.6% | 5.2% |

| Dallas | (2.1%) | (1.7%) | 1.3% | 3.9% |

| Orlando | (2.1%) | (1.3%) | 1.9% | 6.0% |

Single-Family Rentals on the Rise

The single-family rental market is also seeing its own trends, with average rents increasing by $5 to $2,178. While year-over-year growth appears less robust—showing a decrease of 0.4% for lifestyle properties but a 1.9% rise for RBN—there remains an active marketplace. Notably, regions such as Detroit and Kansas City have experienced year-over-year rent growth.

The national occupancy rate for single-family rentals sits at 94.8%, indicating a slight increase and hinting at evolving tenant patterns.

By examining these metrics and trends, one can glean valuable insights into both the opportunities and challenges present in the current rental market landscape. The interplay between economic factors, tenant demands, and market responses continues to shape what is bound to be an interesting year ahead for renters and property owners alike.