Nevada’s Bold Move: Tax Incentive Package to Boost Film Industry in Summerlin

Overview of the New Legislation

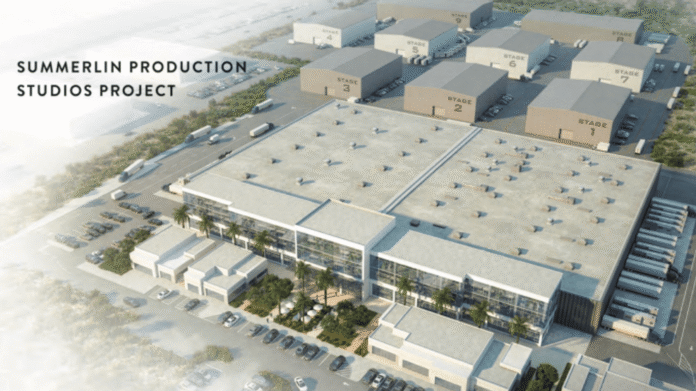

In an exciting development for the entertainment industry and local education funding, a Nevada Assembly committee has advanced a groundbreaking bill aimed at establishing a tax incentive package for filming movies and television shows in Summerlin, a community in west Las Vegas. Known as AB 238, the bill could allocate up to $95 million annually in transferable tax credits specifically for the operations at the proposed Summerlin Studios.

Committee Discussions and Amendments

During a recent session, the Assembly Committee on Ways and Means delved into the intricacies of AB 238. After thoughtful discussions, the committee approved the bill, which now includes amendments that will create a "production studio entertainment district." This innovative designation means that certain Clark County taxes generated within the studio’s boundaries will contribute to pre-kindergarten programs managed by the Clark County School District.

Economic Impact: Job Creation and Diversification

Advocates of the tax package argue that establishing a film studio will significantly diversify Southern Nevada’s economy, reducing its dependence on tourism and gaming. By fostering a robust film industry, the project could create thousands of new jobs in various sectors, from production roles to marketing and technical positions. The potential influx of jobs is seen as a necessity, particularly in a region striving to enhance its economic resilience.

Accountability Measures for Development Partners

Primary sponsor Assemblymember Sandra Jauregui emphasized the need for accountability in her amendments. The bill stipulates that major development partners—such as Sony Pictures and Warner Bros. Discovery—must meet specific obligations. This includes a $4.5 billion commitment to production spending over 15 years. Regular check-ins will be implemented to ensure compliance with these obligations, ensuring that the project remains on course to meet its proposed milestones.

Strict Consequences for Non-Compliance

In an effort to protect the interests of the state and taxpayers, stringent penalties are woven into the legislative framework. If the project fails to reach certain benchmarks, the studios could face millions of dollars in fines. Additionally, should construction pause indefinitely, the state reserves the right to impose a lien on the property, effectively allowing it to seize the assets as collateral if the studio doesn’t materialize. This rigorous oversight aims to mitigate risks associated with the significant investment being made.

Voices of Dissent

While the prospects of a flourishing film industry in Summerlin captivate many, critics have raised valid concerns about the financial implications of such tax incentives. Some argue that similar packages in other states have not yielded significant returns, questioning whether taxpayers should foot the bill for what they perceive as corporate handouts. Alexander Marks, deputy director of the Nevada State Education Association, voiced apprehensions about the state’s education funding status, stating, “Nevada can’t afford these handouts to corporations.” With a staggering $604 million shortfall in education funding, critics fear these incentives may further divert vital resources away from pressing educational needs.

Future of AB 238

The timeline for when AB 238 may receive a full vote from the Assembly remains uncertain, with the final day of the legislative session looming on June 2. As the legislative clock ticks down, both supporters and detractors continue to advocate passionately for their respective viewpoints, making it a pivotal moment for Nevada’s economy and its education system.

As discussions unfold and developments continue, the attention on Nevada’s legislative decision could set the stage for a transformative jump-start to the film industry in the region, all while raising critical questions about funding priorities and the sustainability of such major projects.